Nukleus Office Solutions IPO is an immovable price issue of Rs 31.70 crores. The Issue is entirely a fresh issue of 13.55 lakh shares. Nukleus Office Solutions IPO opens for subscription on February 24, 2025, to closes on February 27, 2025. The allotment for the Nukleus Office Solutions IPO is probable to be finalized on Friday, February 28, 2025. Nukleus Office Solutions’ IPO will be a slant on BSE SME with a tentative listing date fixed by Tuesday, March 4, 2025.

Nukleus Office Solutions IPO price is ₹234 per share. The minimum lot size for an application is 600. The minimum sum of investment required by retail investors is ₹1,40,400. The minimum lot size speculation for HNI is two lots (1,200 shares), amounting to ₹2,80,800.

Sundae Capital Advisors is the book-running lead director of the Nukleus Office Solutions IPO, while Bigshare Services Pvt Ltd is the registrar for the Issue. The sole maker of Nukleus Office Solutions’ IPO is Nikunj Stock Brokers Limited.

Nukleus Office Solutions Limited Description

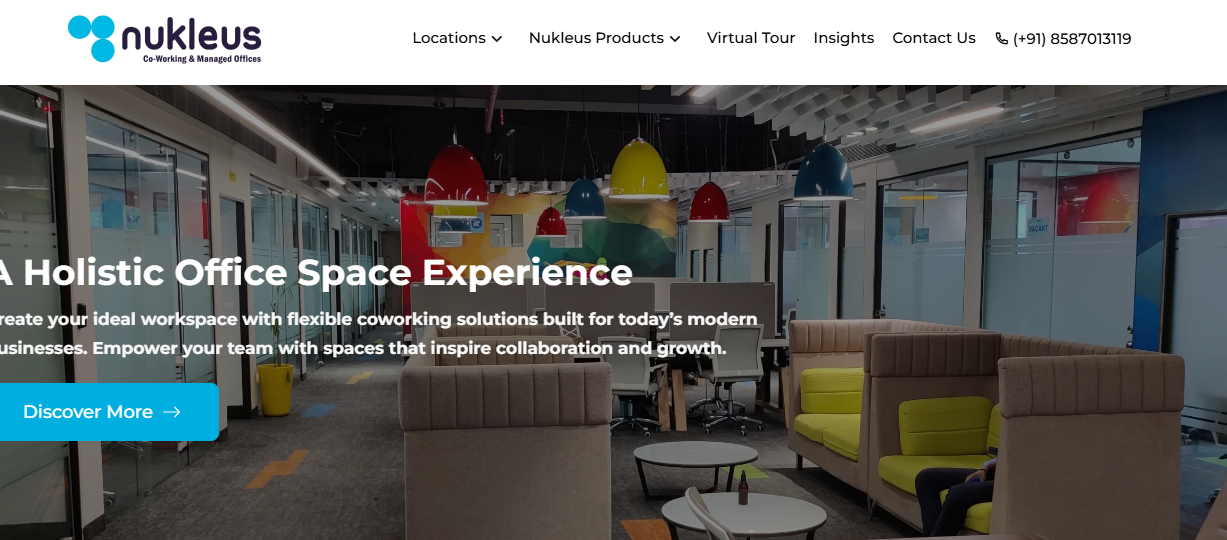

United in December 2019, Nukleus Office Solutions Limited offers co-working and accomplished office spaces in Delhi NCR, featuring furnished and flexible workspaces like dedicated desks, private cabins, conference rooms, startup zones, and virtual offices.

The Company offers many office solutions for startups, SMEs, large enterprises, professionals, and entrepreneurs. They provide fully overhauled workspaces for 50-500-seat enterprises. As of December 31, 2024, the Company operated seven flexible workspaces besides 4 Managed Offices in the Delhi NCR, providing 2,796 total seats with 88.48% occupancy. As of December 31, 2024, the Company had a total of 30 employees in various departments.

Nukleus Office Solutions Ltd IPO Details

Initial public offer of up to 13,54,800 equity bonds of the face value of Rs. 10 each (equity shares) of Nukleus Office Solutions Limited (company/issuer) for cash at a value of Rs. per equity share (including a share premium of Rs. per equity share) (issue price) aggregating up to Rs. crores. The Issue includes promoters’ contribution of 2,89,800 equity shares aggregating up to Rs. crores by the agents (promoters’ contribution) and a reservation of up to 53,400 equity shares amassing up to Rs.crores for subscription by market maker (market maker reservation portion).

The Issue less the promoter’s contribution and market maker reservation portion is hereinafter referred to as the net Issue. The issue (exclusive of promoter contribution) and the net Issue shall constitute 26.41% and 25.09%, respectively, of the post-issue paid-up equity share money of the Company.

Objects of the Issue (Nukleus Office Solutions IPO Objectives)

The Company offers to utilize the Net Proceeds from the Issue towards the following objects:

- Capital expenditure and security credit towards the establishment of new centers;

- Building up technology platform, integration of all centers, online client interaction, and mobile application;

- Advertisement expenses near enhancing the visibility of our brand and General corporate purposes

Nukleus Office Solutions Ltd Contact Details

- Nukleus Office Solutions Ltd, Office No 56-2, Pinnacle Busine.Park, Mahakali Caves Road, Mumbai – 400093

- Phone – 91-22-62638200

- Fax – 91-22-63638299

- Email – cs@nukleus.work

- Website – www.nukleus.work

- Nukleus Office Solutions IPO Registrar

- Bigshare Services Pvt Ltd

- Phone: +91-22-6263 8200

- Email: ipo@bigshareonline.com

- Website: https://ipo.bigshareonline.com/IPO_Status.html

- Nukleus Office Solutions IPO Lead Manager(s)

- Sundae Capital Advisors (Past IPO Performance)

- IPO Lead Manager Performance Summa

Read More: Tejas Cargo NSE SME IPO Opening Day: Subscription, Key Details, Dates and More